how to pay indiana state estimated taxes online

For best search results enter a partial street name and partial owner name ie. Take the renters deduction.

How Do State And Local Sales Taxes Work Tax Policy Center

Know when I will receive my tax refund.

. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax accounts in one convenient location 247. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Have more time to file my taxes and I think I will owe the Department. There are several ways you can pay your Indiana state taxes. Know when I will receive my tax refund.

Find Indiana tax forms. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. Select the Make a Payment link under the Payments tile.

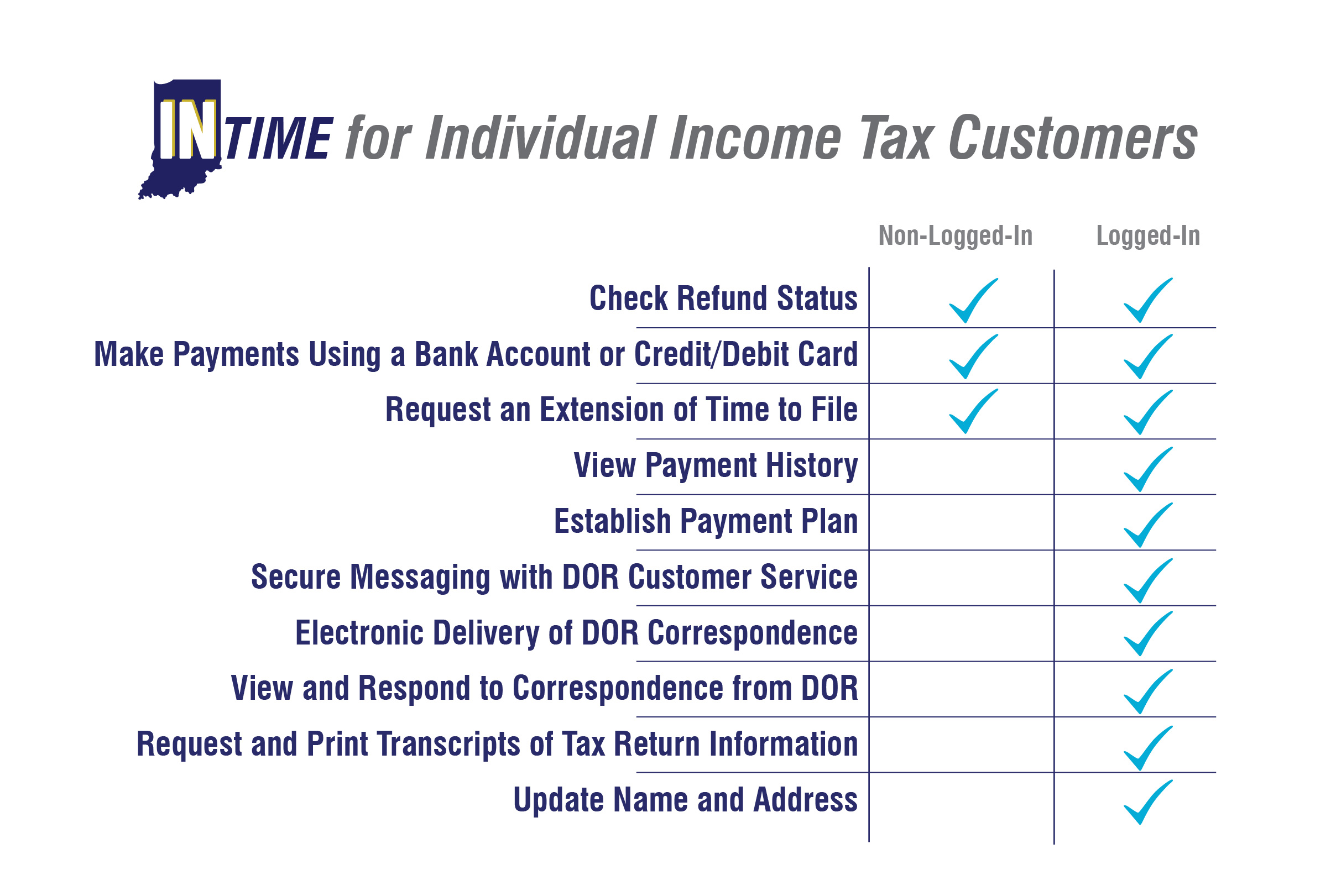

INtax only remains available to file and pay the following tax obligations until July 8 2022. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. Find Indiana tax forms. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

Claim a gambling loss on my Indiana return. Claim a gambling loss on my Indiana return. Have more time to file my taxes and I think I will owe the Department.

How do i pay state taxes electronically for Indiana on epay system. Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours. Find Indiana tax forms.

The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates. Follow the links to select Payment type enter your information and make your payment. You can find your amount due and pay online using the intimedoringov electronic payment system.

We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest. To make an individual estimated tax payment electronically without logging in to INTIME. If you did make estimated tax payments either they were not paid on time or you did not pay enough to.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Pay my tax bill in installments. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Take the renters deduction. A representative can research your tax liability using your Social Security number. INTAX only remains available to file and pay special tax obligations until July 8 2022.

Search by address Search by parcel number. Have more time to file my taxes and I think I will owe the Department. Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours.

If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form. Pay my tax bill in installments. Pay my tax bill in installments.

You may qualify to use our fast and friendly INfreefile to file your IT-40 IT-40PNR or IT-40RNR directly through the Internet. Know when I will receive my tax refund. Claim a gambling loss on my Indiana return.

Have more time to file my taxes and I think I will owe the Department. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Take the renters deduction.

Send in a payment by the due date with a check or money order. The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan. Estimated payments may also be made online through Indianas INTIME website.

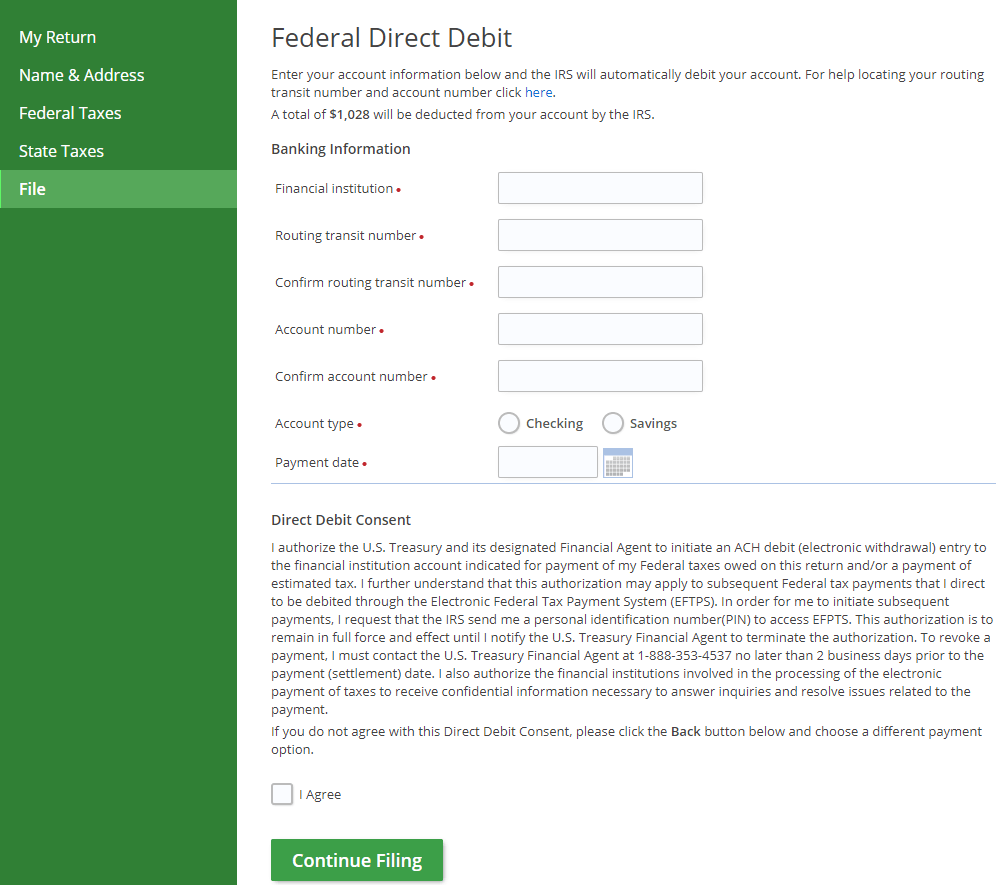

If you have not yet filed your tax return when you reach the File section you have the option to either have the amount due debited from your bank account or you can select the option to mail a checkOr you can use the link below to pay your state taxes due. To determine if these changes will affect your 2021 estimated tax payments see Estimated tax law changesIf you need to adjust already-scheduled payments due to the new brackets and rates you may cancel and resubmit. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments.

Pay my tax bill in installments. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number.

Find Indiana tax forms. You will receive a confirmation number immediately after paying electronically via INTIME. If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am.

When you receive a tax bill you have several options. June 5 2019 250 PM. Estimated payments can be made by one of the following methods.

Know when I will receive my tax refund. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

430 pm EST. The tax bill is a penalty for not making proper estimated tax payments. Claim a gambling loss on my Indiana return.

Search for your property. Contact the Indiana Department of Revenue DOR for further explanation if you do. If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of Revenue at 317-232-2165.

124 Main rather than 124 Main Street or Doe rather than John Doe. Take the renters deduction. If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face late tax payment.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Where S My State Refund Track Your Refund In Every State Taxact Blog

Indiana Dept Of Revenue Inrevenue Twitter

Dor Keep An Eye Out For Estimated Tax Payments

Cigarette Taxes In The United States Wikipedia

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

How Do State And Local Individual Income Taxes Work Tax Policy Center

E File Indiana Taxes Get A Fast Refund E File Com

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Dor Owe State Taxes Here Are Your Payment Options

How Do State And Local Individual Income Taxes Work Tax Policy Center

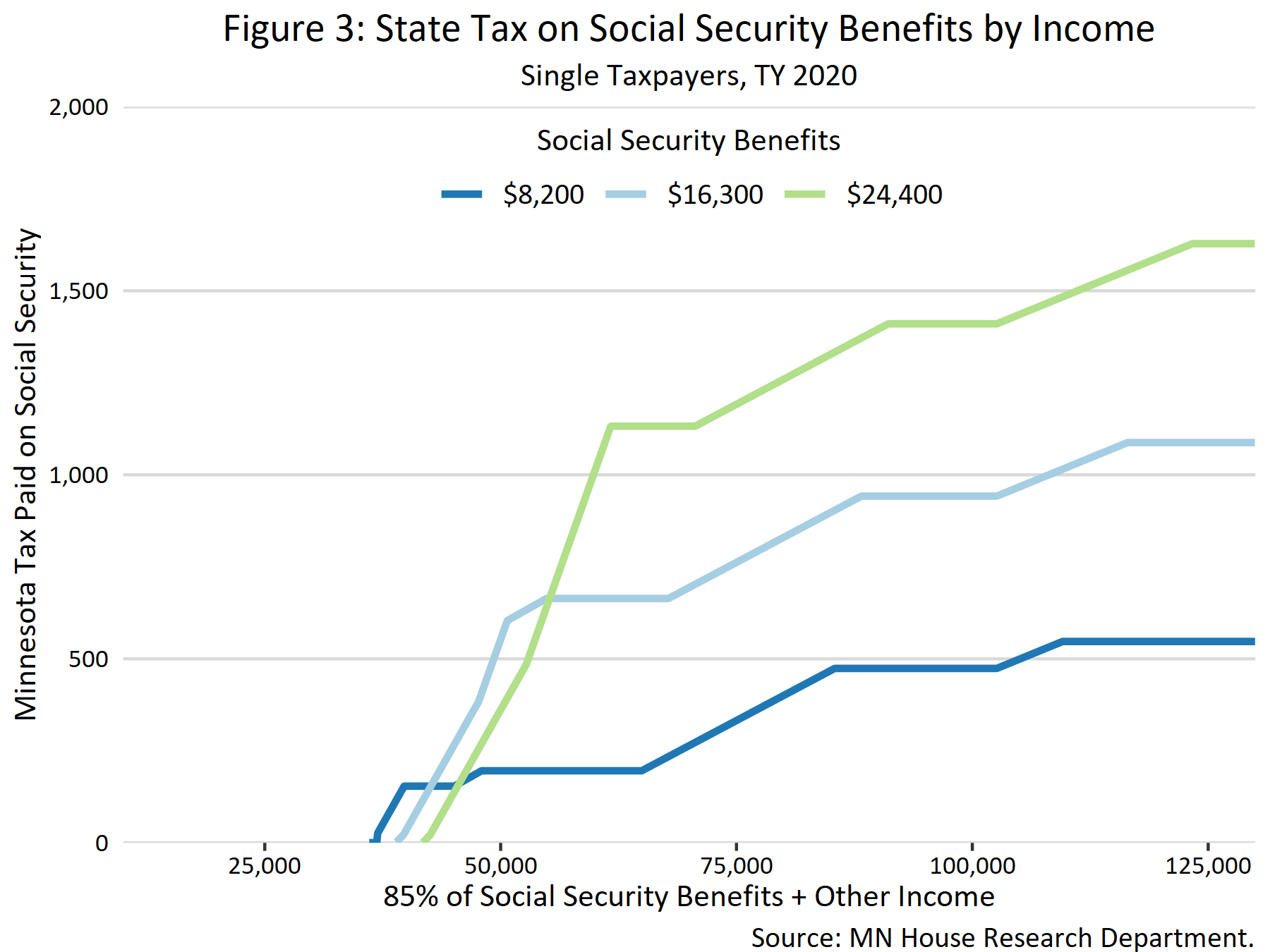

Taxation Of Social Security Benefits Mn House Research

Indiana State Tax Information Support

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)